The Home Depot, more so than Lowe’s, views contractors as seminal to its growth. It has installed “pro desks” in more than 1,400 stores—up from 165 in early 2000—to handle credit, will-call, and delivery services, as well as phone-in or fax-ahead orders. But those desks, for many remodelers, are lacking when it comes to serving the pros. “The only person you can ever get on the phone is some 16-year-old who doesn’t know jack,” says Marc Ridenour, president of Lawrence, Kan.–based Natural Breeze Remodeling, which has few options other than The Home Depot in his market for most products.

Ridenour’s criticism is voiced by many other remodelers who point to less-than-stellar inside sales as one of the main reasons why they spurn the big boxes’ advances and look to pro dealers to fill the gap.“[Industry consultant] Walt Stoeppelwerth keeps recommending that remodelers hook up with big boxes, but that would be like aligning ourselves with dumb and dumber,” quips Shigley, whose company will spend about a quarter of this year’s $800,000 revenue on materials. “Their service is dreadful.”

On the other hand, remodelers also still need convincing that even most pro suppliers and distributors are fully committed to selling into their sector. “If you’re not a big builder, you don’t get the same service,” believes McGrath. Crane, a Nashville remodeler who is also president of the NAHB Remodelors Council, says remodelers are “justified” in their perception. “The new-home industry is easier for suppliers to identify,” he observes.

Still, the long-term prospect of rising interest rates that could slow housing demand, coupled with estimated remodeling spending activity of $236 billion in 2004, according to the Harvard University Joint Center for Housing Studies, is making the remodeling sector more attractive to pro dealers nationwide. And remodelers don’t see their business backing off any time soon, with 66 percent of survey respondents saying they expect to do more volume in 2004 than they did in 2003 (see Figure 5). “We are, after all, builders, although we’re in the secondary market,” says Shigley. “Most distributors chase volume, but I try to explain that they are leaving a lot on the table in terms of money and relationships.” —John Caulfield is a contributing editor to PROSALES.

About the Survey The findings of the Remodeling Purchasing Panel study are based on e-mail responses from 418 remodeling professionals who subscribe to REMODELING magazine, a sister publication of PROSALES. Questionnaires were e-mailed to 2,000 REMODELING panel participants between June 3 and June 20, 2004, generating a response rate of 20.9 percent, which is considered above average for an e-mail survey. The online survey was hosted by Specpan, a Denver-based market research company owned by The Farnsworth Group of Indianapolis. Specpan compiled the data and analysts at The Farnsworth Group prepared a report on the survey results, which had a data accuracy rate of ±6 percent. (Note: Remodelers interviewed for this story were not necessarily participants in the e-mail survey itself.)

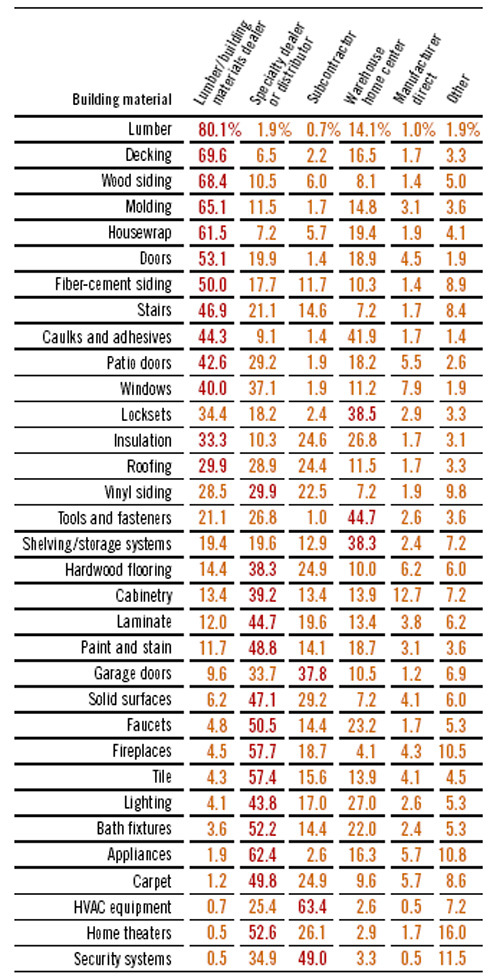

Where Remodelers Purchase Building Materials Percent of respondents who indicated their firm purchases building products at this type of establishment. The type of establishment with the greatest response is highlighted in red.

NUMBERS MAY NOT ADD UP TO 100 PERCENT DUE TO ROUNDING AND NON-RESPONSES. SOURCE: 2004 PROSALES REMODELING PURCHASING PANEL STUDY

Job Functions Involved in Specifying/ Purchasing Building Products SOURCE: 2004 PROSALES REMODELING PURCHASING PANEL STUDY

Sidebar: Team Building By dedicating a sales squad to serve remodelers, Scherer Bros. is winning in the field.

Last year, Scherer Bros. Lumber generated about one-quarter of its $202 million in revenue from remodelers. This Brooklyn Park, Minn.–based pro dealer wants to eventually increase that take to one-third, and a big factor toward achieving its goal could be “The Remod Squad,” a sales team Scherer put together six years ago that now has 14 salespeople dedicated to this customer group, who collectively wrote $18 million in business in 2003.