Leading that team is Dave Klun, a former home builder and remodeler who has worked at Scherer Bros. for 17 years. Since joining The Remod Squad in 1998, Klun has been on a mission to make all of Scherer’s five yards more accountable for the service they offer remodelers. “It’s amazing what happens when you focus on remodelers, but it’s a tireless effort,” says Klun. “A remodeler’s loyalty is strong, but it has to be earned.”

Scherer Bros. used to handle remodelers’ orders through its main yard’s inside sales office—what it calls its “city desk.” But in the late 1990s, remodelers were outgrowing that desk’s capacity to service them efficiently. At Scherer’s behest, Klun interviewed 48 remodelers to learn more about their needs. He found that service consistently ranked higher in importance than price for the vast majority.

Klun observes that most pro dealers let remodelers down when they treat them like builders. For example, remodelers often work mostly on homes in urban areas that don’t have alleyways. Consequently, dealers need to use smaller delivery trucks and schedule shipments closer to when the remodeler is ready to install the products. Klun recalls one remodeling job to which Scherer delivered materials a few days early and stored the products in the owner’s garage. That night, a hailstorm damaged the owner’s car, which had been relegated to the driveway. “That was a paint job we had to pay for.”

He adds that dealers need to recognize that remodelers generally order in different, usually smaller, quantities than builders. That’s where Scherer’s value-added services—its truss and panel plants, and shops for windows and molding—have been a “huge benefit” in pitching remodelers on the company’s competitive advantages. In fact, Klun attributes The Remod Squad’s success partly to the commitment of Scherer Bros.’ owners to the concept. “You need the rest of the company behind you, orchestrating.”

Klun, who never thought he would end up as The Remod Squad’s “quarterback,” is making the best of his opportunities. Last year, he helped Andersen Windows launch a remodeler-friendly program in several Midwestern markets. And Klun envisions himself becoming a “mentor,” educating dealers and remodelers about how they can work together. “My goal,” he says, “is to clean up the remodeling industry.”

Importance of Criteria in Selecting a Supplier SOURCE: 2004 PROSALES REMODELING PURCHASING PANEL STUDY

Ways Pro Yards Can Improve Sales to Remodelers SOURCE: 2004 PROSALES REMODELING PURCHASING PANEL STUDY

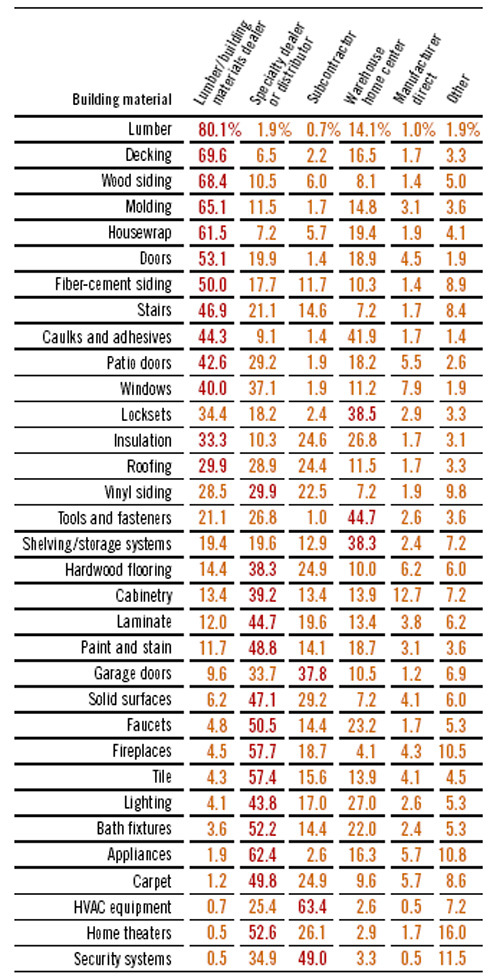

Sidebar: Sub Culture Remodelers rely heavily on subs in the purchasing process.

Shigley Construction in Wichita, Kan., employs subcontractors exclusively for all of its projects, and those subs, who install plumbing, electrical, HVAC, and roofing, “buy their own stuff,” says owner Tim Shigley. But his company’s lead carpenter or production manager purchases the lumber and building materials that Shigley builds with.

This balancing act is performed every day by remodelers whose companies rely on subs for labor. Around one-fifth of the more than 400 remodelers polled in PROSALES’ exclusive Remodeling Purchasing Panel study (see “About the Survey,” page 54) say their subs are involved in specifying or purchasing building products. And all of the remodelers interviewed for this article give subs some latitude in choosing which brands they buy and the stores they purchase from. “We let them buy all the time because we want them to warranty what they install,” says Joe McKinstry, who owns Joseph McKinstry Construction in Seattle.