Source: JCHS tabulations of US Bureau of Labor Statistics, Current Employment Statistics and US Department of Commerce, Monthly Retail Trade Survey.

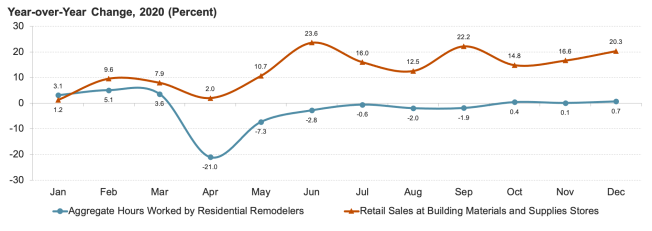

Professional remodeling activity gradually recovered in 2020 from a pandemic-induced drop, while sales of home improvement products rebounded much more sharply.

The U.S. economy contracted in 2020 as a result of the coronavirus (COVID-19) pandemic, but the home improvement industry remained a bright spot. According to Harvard University’s Joint Center for Housing Studies (JCHS), while the economy shrank by 3.5% in 2020, spending on home improvements and repairs grew more than 3% to nearly $420 billion.

Though many professional remodeling projects were halted in the early stages of the pandemic, DIY renovations surged. The flexibility afforded to some households with remote work also increased the demand for larger homes and yards in lower-cost and less dense areas of the country, according to the JCHS’s Improving America’s Housing 2021 report.

While the strength of the home remodeling market made 2020 the tenth consecutive year of expansion for the industry, the pandemic disrupted several other long-term industry trends.

“From 2010 to 2019, homeowners largely relied on professional contractors, and remodeling activity was heavily concentrated in coastal metros,” Kermit Baker, director of the Remodeling Futures Program at the JCHS, said in a news release. “But in 2020, amid concerns about having contractors in the home, DIY projects gained new popularity, and remodeling activity shifted to lower-cost metros where larger shares of younger households could afford to own homes.”

In March of 2020, 60% of respondents to a homeowner survey had begun at least one DIY maintenance or improvement project in the previous two to three weeks. By early May 2020, that share had jumped to 80%. The pandemic also saw many urban renters purchase homes in outlying communities in search of more space and lower housing costs.

According to the JCHS, many homeowners with lower incomes struggled with keeping up with mortgage payments in 2020 and were not as able to engage in home maintenance projects.

“Lower-income owners were more likely to have lost employment income due to the pandemic,” Abbe Will, associate project director of the Remodeling Futures Program, said. “If their finances do not improve enough to cover back mortgage payments and deferred maintenance, the already-large disparity in housing conditions between lowest- and highest-income homeowners will only grow.”

While there are still large portions of the U.S. population who have not yet recovered from the economic impacts of the pandemic, the JCHS projects there will be sustained growth in home remodeling.

“In the short term, many homeowners who deferred projects—both larger and small—in 2020 are expected to complete those renovations once the pandemic is over,” Baker said. “Additionally, there has been an upturn in homeownership as younger households look to purchase homes, the number of multigenerational households has been growing, and remote work has given people more locational flexibility and the desire to modify homes.”

In addition to pandemic-related factors, the increasing incidence and severity of climate-related disasters in the U.S. are also likely to increase home improvement expenditures. In 2019, 10% of homeowner improvement expenditures, or $26 billion, were caused by climate-related events. Much of the spending was due to hurricanes and tornadoes, according to the JCHS, with improvement spending concentrated in the southern region. According to the JCHS, 41% of home improvement expenditures in Houston were for disaster repairs, pushing it to the third largest remodeling market in 2019. A record number of billion-dollar disasters in 2020 and the growing number of homes located in vulnerable areas contribute to projections that spending on disaster-related repairs will continue to rise in the U.S.