Some of us are old enough to remember entertainer Dean Martin. He is famously quoted as saying: “Good judgment comes from experience. And experience? Well, that comes from poor judgment.”

Regardless of whether Martin made this statement or not, it has merits. Some LBM executives are displaying very poor judgment by not understanding what’s happening in the manufacturing area when costs are on the rise. This sentiment is especially true when it comes to tight labor markets.

Keeping your costs in line is hard enough when you’re constantly fighting material costs in an inflationary market. However, it’s not only materials that are likely causing you headaches—the tightening of labor probably is as well. That, in turn, pressure your company to stay competitive when it comes to labor rates.

Many of you are slow to the idea that you can’t expect your labor rates to stay flat while also somehow constantly filling the vacancies with new hires and keeping your costs and profits in line.

When you encounter manufacturing issues such as output, quality, and cost, there are two simple questions to answer:

- What is your labor rate-to-sales ratio as a percentage? (Shop-labor costs with burden rates divided by total sales).

- What is your labor turn rate in your manufacturing? In other words, how many people do you have to hire monthly compared with the total staff to keep all of your positions filled?

It’s a big red flag for a company if the ratio of shop-labor to sales exceeds 15%; a healthy labor cost–to–sales ratio falls below that figure. A good goal for companies is a ratio between 9% and 12%—yet some LBM operations sustain labor cost-to-sales ratios hovering between 17% and 21%.

Also, a company with high ratios is constantly hiring to fill positions. In such cases, two things can be concluded about such a firm without even knowing any other details about it:

- The quality of the company’s manufacturing is suffering because the new personnel lack the skills its longtime employees have; and

- Output is suffering because the new workers can’t produce at the same rate as the experienced personnel. Also, output is suffering because the company isn’t actually keeping all its positions filled and the same issue of quality is hampering output.

You can talk all you want about creating a great working environment. But if you aren’t keeping up on labor-market wage conditions, you’re only fooling yourself. All of you know this because of the labor-rate increases you’re paying your truck drivers. Increased rates haven’t been as plain to see for the manufacturing personnel. So, when you’re ready to come to terms with pay-rate adjustments, keep faith and know there are solutions besides expensive equipment updates.

Purchasing new equipment with some type of automation can and will reduce your labor per unit, but only up to a point. I don’t know how many times executives have told me their salesperson lied to them because they didn’t get as much of an efficiency gain they were promised or expecting. It’s my job to explain in detail how to change their processes and actually achieve their goals while reducing their labor costs to sales. So, let’s take a look at some basic math to help explain where I’m going with this.

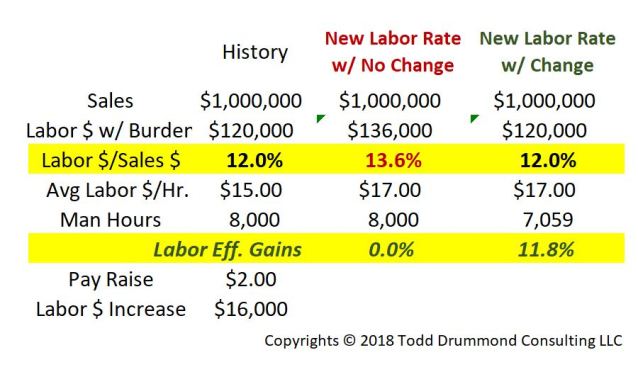

For every $1 million in sales, a labor-cost ratio of 12%, and an average shop-labor rate of $15.00 with burden, the total labor is $120,000. That equals about 8,000 man-hours, ignoring overtime. What if you need to raise your shop’s labor rate by $2.00? How will that affect the bottom line?

It’s simple math. Your labor rate will increase by $16,000, which raises your labor ratio to 13.6% from the 12% historical rate. That’s coming directly off the bottom-line numbers of your profits. But what if you could increase your shop-labor efficiencies while still increasing your hourly rate? This can, and is, being done by your competitors, and they’re not doing this by just purchasing new equipment.

It’s not just automation, and it’s not just about the manufacturing process. Lean manufacturing includes everyone. Sales, design, and administration have a big hand to play in helping manufacturing get the efficiency gains it needs to achieve.

Too many of you are focused only on the shop processes while overlooking all of the other areas that contribute to lost manufacturing efficiency. An example is stopping a work-in-process order that’s already been cut in order to do a rush order. That happens all too often with companies that have yet to figure out proper scheduling and better order-process practices.

All operations need a blend of automated and nonautomated equipment, balanced with proven, practical, lean principles. By combining the best practices of industrial engineering, such as proper time benchmarks—using man-minutes rather than board footage—along with lean practices, an 11.8% gain in productivity is a low bar to clear. Many manufacturers are getting more than that in efficiency gains, but when I start throwing out those numbers, too many people fall into the nonbelievers camp. However, when your gross margins are above 35%, a 9% to 12% labor-to-sales ratio should be the goal for your manufacturing shop, no matter your labor rates.