Freddie Mac today released the results of its Primary Mortgage Market Survey, showing that the 30-year fixed-rate was the lowest in three years.

“As rates fell for the third consecutive week, markets staged a rebound with increases in manufacturing and service sector activity,” said Sam Khater, Freddie Mac’s chief economist. “The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

News Facts

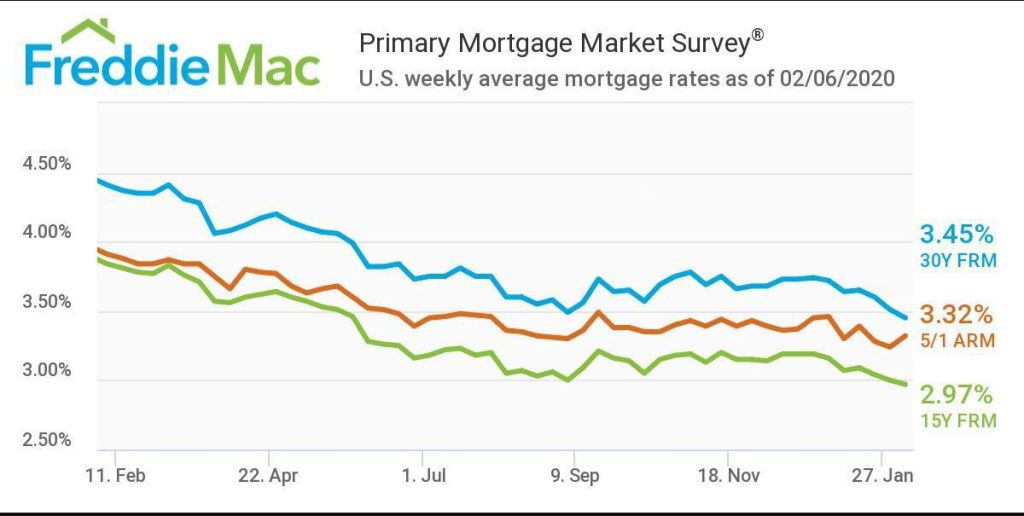

- 30-year fixed-rate mortgage averaged 3.45% with an average 0.7 point for the week ending February 6, 2020, down from last week when it averaged 3.51%. A year ago at this time, the 30-year FRM averaged 4.41%.

- 15-year fixed-rate mortgage averaged 2.97% with an average 0.7 point, down from last week when it averaged 3.00%. A year ago at this time, the 15-year FRM averaged 3.84%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.32% with an average 0.2 point, up from last week when it averaged 3.24%. A year ago at this time, the 5-year ARM averaged 3.91%.