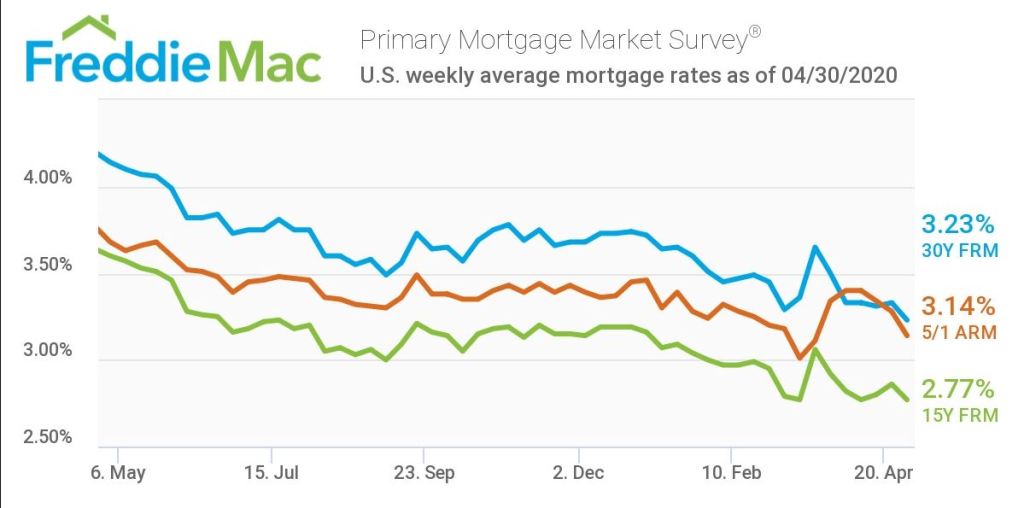

Freddie Mac today released the results of its Primary Mortgage Market Survey, showing that the 30-year fixed-rate mortgage averaged 3.23%, the lowest rate in our survey’s history which dates back to 1971.

“The size and depth of the secondary mortgage market is helping to keep rates at record lows. These low rates are driving higher refinance activity and have modestly helped improve purchase demand from their extremely low levels in mid-April,” said Sam Khater, Freddie Mac’s chief economist. “While many people are benefiting from low mortgage rates, it’s important to remember that not all people are able to take advantage of them given the current pandemic.”

News Facts

- 30-year fixed-rate mortgage averaged 3.23% with an average 0.7 point for the week ending April 30, 2020, down from last week when it averaged 3.33%. A year ago at this time, the 30-year FRM averaged 4.14%.

- 15-year fixed-rate mortgage averaged 2.77% with an average 0.6 point, down from last week when it averaged 2.86%. A year ago at this time, the 15-year FRM averaged 3.60%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.14% with an average 0.4 point, down from last week when it averaged 3.28%. A year ago at this time, the 5-year ARM averaged 3.68%.