The Home Depot is an exceptionally well-run business, but it is facing broader issues that impact the larger economy—especially home builders, suppliers, and remodelers. We expect the company’s earnings call, scheduled for Aug. 15, to be enlightening and to touch on several key economic issues. You should pay attention, even if you ignored their calls in the past or are in a different industry.

Shifts in the Consumer Wallet

To say The Home Depot is relevant is an understatement. With nearly $160 billion in revenue, The Home Depot measures its revenue as share of personal consumption expenditure (as in: two-thirds of GDP).

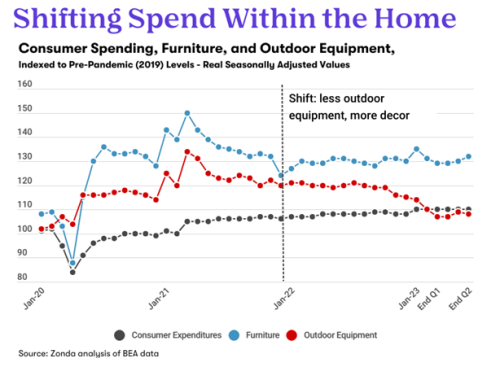

However, consumers are now shifting how they spend on their homes, especially in the past six months. Compared with the same time last year, U.S. Bureau of Economic Analysis data shows consumers are shifting to buying more interior products like furniture and decor, while at the same time cutting back on spending on outdoor equipment (down -11% in volume). Perhaps it’s not by accident that The Home Depot’s digital presence is looking more threatening to Ikea and other decor competitors.

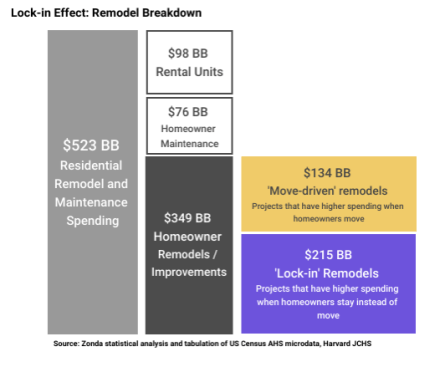

Add to that the “lock-in effect,” which we believe causes a rotation in how consumers spend on their home. About 41 million homeowners are locked in to their home (more than 180 basis points below current mortgage rates), and new research published by the National Bureau of Economic Research suggests they are prone to move nearly half as often as a result.

Zonda estimates that about $215 billion of spending is tied to lock-in remodel categories, which are remodel segments that have higher spending outside of the initial move-in “honeymoon” when homeowners update their home. The Home Depot’s book of business will likely shift accordingly. Importantly, it also gives us direct evidence of what parts of the home are the largest pain points for consumers who may not yet be able to afford to remodel or move but are deferring their spending.

Pricing Power

Critically, The Home Depot second-quarter earnings call will give us a clearer view of business-to-consumer pricing power to end consumers, which we think could be changing meaningfully. Our independent research has suggested pricing power in 2023 has progressed roughly in this sequence:

- Q1 2023: Incrementally worse pricing power (negative)

- Q2 2023: Marginally better (stabilization)

- Prelim Q3 run rate: Mixed bag of pricing power in the third quarter, with the largest remodels weakening the most, even while suppliers raise prices. Curious to see whether this is The Home Depot’s experience, but we will be concentrating closely on July/August pricing commentary, if any is shared, and we suggest you do the same.

Professional Labor Shift

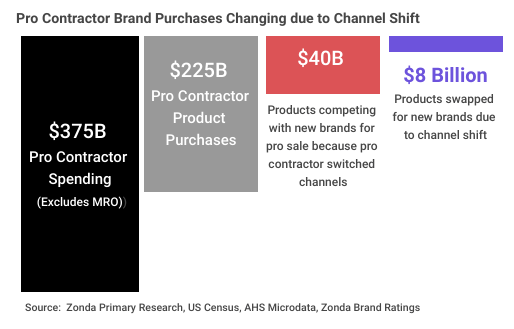

A battleground for pro contractors is underway, and The Home Depot is at the center of it. We think about $8 billion of revenue will shift hands among suppliers just because of the friction from pro contractors shifting channels and bumping up against new brands/products versus 2021-22.

There is some evidence that pro contractors have more “veto power” on products installed in the home than perhaps any time in the past 40-plus years of The Home Depot’s existence. In fact, pro labor is so important that The Home Depot’s investor relations team point to “winning the pro” as fundamental to the company’s long-term earnings growth. What we are listening for: evidence of pro contractor stability, rural versus urban contractor trends, and a shift of business among professionals.

We believe we are at a unique point in time, and The Home Depot’s upcoming earnings call may be a particularly enlightening window into what is around the corner.

In the long run, this decade appears to be a unique setup for housing and remodeling (the “Golden Age of Remodeling” but with a cyclical slowdown in the middle). Pockets of data are already beginning to show underlying “festering deferrals” among households that are planning to move or improve their home but have not yet been able to. Those households likely appear as fewer sales today (as of the second quarter) but will reemerge as future sales when the industry stabilizes. At the same time, there is some evidence of a pull forward among certain categories (hello, outdoor grills), which is just shaking out now.

The 2020–30 decade may well become one of the more remarkable periods of housing consumption, in part because of the combination of low inventory along with factors that cause frustration in the home (age of housing, demographics, poor quality matches, etc.). The Home Depot’s second-quarter earnings call is important to listen to because it captures an exceptionally well-run business amid a rapidly shifting market.