Change comes slowly to the construction industry as builders often stick with what they know best to lower their risks. But change does come, and the current shortage of skilled labor is one factor encouraging builders to use products that make tighter, more energy-efficient building enclosures in less time.

Industry analysts call it “multi-functionality” or the “systems approach,” but the result is enhanced sheathing, insulation and weather-resistive barriers that help builders do more in less time by combining several steps into one. At the same time, manufacturers are introducing products that help builders meet growing expectations for tighter, better-insulated enclosures.

“There is a shortage of construction workers in the United States,” says Nancy Musselwhite, an industry analyst with Principia. “Anything you can do to take time off the application of a product—if you can combine two products into one, if you can make it go faster, if you cant take labor out—a builder is likely to look at it.”

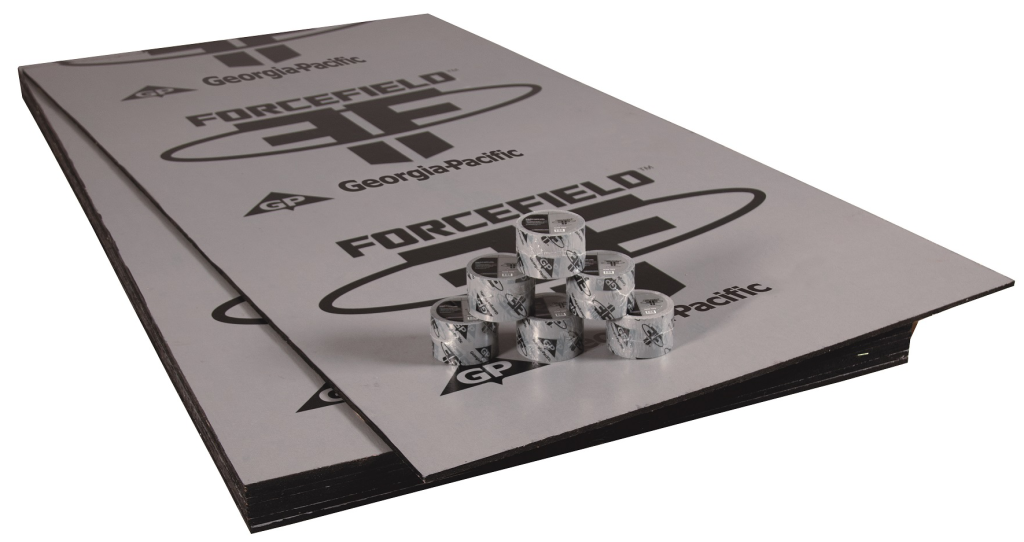

Sheathing That Does More

Huber Engineered Woods has had a runaway bestseller with its Zip System sheathing for both walls and roof. It combines structural sheathing and a coating that eliminates the need for a separate weather-resistive barrier (WRB). When used in conjunction with a proprietary sealing tape, the sheathing is an effective air and moisture barrier.

Huber dominates this part of the sheathing market, but it’s no longer alone. Georgia-Pacific introduced a product called Force Field. There also are entries in the coated sheathing category from Ox Engineered Products (Thermo-Ply) and RoyOMartin (Eclipse, a radiant barrier).

Using these saves the builder time. They make it easier for contractors to meet air-tightness standards in newer model building codes and pass green certification standards. The treated sheathing also provides an integral layer of moisture protection; unlike roofing shingles and roofing underlayment, it probably won’t blow off in a big storm.

Huber now offers a version of its Zip sheathing that comes with a layer of polyisocyanurate insulation to reduce thermal bridging. Zip System R-sheathing, which comes in four thicknesses and with R-values of up to R-12, is the fastest-growing product in its portfolio.

“Contractors don’t want to walk around the building more than one time,” says Susanna Ross, also an industry analyst for Principia. “Reducing the number of times you have to apply something is key, so manufacturers are making multi-functional products.”

More Options for WRBs

GreenGuard RainDrop 3D housewrap

Manufacturers continue to broaden offerings for weather-resistive barriers that are applied beneath the cladding, a category that DuPont started with the commercialization of Tyvek 50 years ago. There are now at least nine manufacturers, including James Hardie, Fiberweb, CertainTeed, Owens Corning and Dow.

Newer entries include RainDrop 3D in Kingspan’s GreenGuard product line. RainDrop has a textured surface that enables any water getting past the cladding or flashing to drain away, even when siding has been nailed tightly against it, according to the manufacturer. The product would appear to be aimed at builders who now apply cladding over a vented rain screen , as it combines two steps (applying a WRB and then furring strips) into one.

On the commercial side, USG and Tremco have joined forces to produce Securock ExoAir 430, which melds USG’s Securock glass-mat sheathing and Tremco’s ExoAir fluid-applied air barrier into a single panel.

DuPont

As builders get ever more concerned with meeting air-tightness requirements, flashing and sealing tapes also are becoming more widely used. DuPont’s recently released FlexWrap EZ tape is a flexible sealing tape that stops air leaks around penetrations such as electrical boxes, conduit and plumbing drain lines.

New on the Insulation Front

Recent developments in the thermal insulation category are more about incremental changes rather than revolutionary steps, but green-building advocates have to be pleased with announcements from both Rockwool (formerly Roxul) and Owens Corning that binders containing formaldehyde are being phased out in some of their products.

Rockwool said last spring that the changes would initially affect its light density AFB batt insulation, in part to allay concerns among builders and designers that formaldehyde off-gassing from mineral wool insulation posed health risks. Owens Corning said the no-added formaldehyde binders would be used in its Thermafiber insulation.

Those steps will be welcome news for anyone trying to meet the rigorous requirements of such certification programs as the Living Building Challenge, or gain air quality points under the Leadership in Energy and Environmental Design (LEED) and similar programs. Manufacturers of fiberglass batt insulation have already moved in that direction.

Look for a bigger push into U.S. markets from Rockwool with a new $150 million plant in Jefferson County, W.Va., due to open in the first quarter of 2020, says Musselwhite. The 460,000-square-foot factory will employ an estimated 150 people.

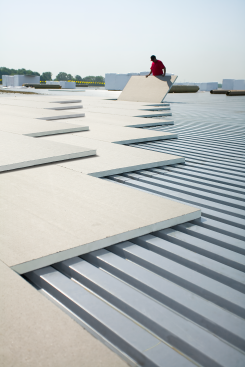

Firestone photo

Polyiso board insulation from Firestone

Firestone Building Products is set to launch a reformulated polyisocyanurate board insulation that improves low-temperature performance. Insulation Product Manager Edward Klonowski says its rebranded Isogard and Enverge boards test at R-6.3 per inch at 40 degrees while the R-value per inch in earlier versions dropped to R-5 per inch at that temperature. They still use Pentane as a blowing agent, Klonowski says, but tweaks in other chemical components made the upgrade possible.

CertainTeed has introduced two new types of fiberglass batt insulation: EasyTouch, which comes with a perforated plastic film coating to reduce dust and make installation less itchy; and SmartBatt, which incorporates a smart vapor barrier to limit vapor transmission into wall cavities when humidity in the walls is low.

Changes in Framing Products

Basic framing doesn’t change quickly—witness the painfully slow adoption of Optimum Value Engineering—but manufacturers have updated several products that either improve durability or save builders time.

Weyerhaeuser has introduced a new coating for its Trus Joist Eastern Parallam PSL beams and columns that reduces moisture absorption while the material is stored in the yard and during construction. Eastern Parallam PSLs are available east of the Mississippi and are made for interior use.

Boise Cascade

Boise Cascade's AJS 24 FM I-joist

Boise Cascade says it has increased production of its AJS 24 FMJ I-joists, designed for use in unfinished basements. The I-joists have a foil coating to meet the ASTM fire test, and have no specific top and bottom orientation to make installation a little easier.

Louisiana Pacific hopes rising framing lumber prices will convince more builders to use its LSLs in selected areas of the house—on kitchen walls, for example—where straight and plumb are worth a few extra bucks. Reid Williams, an application engineer at LP, says the company’s biggest challenge is to convince builders to use a value-added product. But when LP gets a chance to engineer a job and save the builder money, he adds, “it’s usually a slam dunk.”

Rising lumber costs should make light-gauge steel framing more competitive, but even the executive director of the Steel Framing Alliance doesn’t see a dramatic change in its residential market share of 1% or less. There may be more room to grow in the mid-rise building category where steel is a scant 2.5% more than wood before figuring in insurance and other savings, says Larry Williams.

More Prefab Ahead?

A more fundamental change may come with wider adoption of panelized building components. High-end panelizers like Ecocor and Phoenix Haus can deliver Passive House-certified wall and roof sections, but more mainstream panelizers may get a boost as the skilled labor shortage continues to plague builders.

The Modular Building Institute would like to double the current 3.5% prefab market penetration by next year, says Principia’s Ross. That would be a big improvement, but still leave the U.S. industry far behind Canada and Europe.

“People think modular is that little cheap real estate mobile home or the man camp when you have to have people moving from one place to another for big build projects,” she says. “In fact, prefabrication has become a rather sophisticated method of manufacture to improve lead time, to improve the quality of construction, and improve the availability of labor.”

Yards that can supply builders with panelized components will enjoy a competitive edge, she said.