“When the customer takes part in the purchase, it becomes a subtle combination of price, showroom facility, and service,” says Hann’s Douglas. The survey found that 70 percent of custom builders polled send their buyers to suppliers’ showrooms, either on their own or accompanied by the builder’s employees (see Figure 5, below). Dalrymple says Dalco often determines where it buys products by which dealer or distributor has a showroom that’s nearest to where the client resides. Dratch at Koral Builders notes that his clients and their designers either pick out products on their own from the myriad supplier-affiliated showrooms in New York City, or he sends them to specialty distributors like Blackman Plumbing Supply, which has nine area showrooms.

Changing Times Yet many custom builders—and some with extreme prejudice—resist buying from or sending clients to warehouse home centers. In only five categories—tools and fasteners, lighting, locksets, caulks and adhesives, and shelving and storage—did at least 20 percent of the builders polled indicate they purchase at home centers.

Will custom builders change their tune, though, if The Home Depot decides to follow its recent purchase of Williams Bros. Lumber with acquisitions of other pro dealers? And how will dealers, distributors, and other suppliers react if, as a result, the competitive landscape shifts? Rinehart, the Virginia-based builder, worries that big boxes are already putting local dealers out of business. And the next few years could be a period of adjustment for custom builders, when they’ll find out if the personal touch they’re used to receiving from suppliers becomes an embrace or a brush-off. —John Caulfield is a contributing editor for PROSALES.

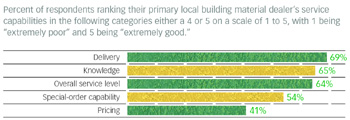

SOURCE: PROSALES 2005 CUSTOM HOME BUILDER STUDY

SOURCE: PROSALES 2005 CUSTOM HOME BUILDER STUDY

SOURCE: PROSALES 2005 CUSTOM HOME BUILDER STUDY

SOURCE: PROSALES 2005 CUSTOM HOME BUILDER STUDY

SOURCE: PROSALES 2005 CUSTOM HOME BUILDER STUDY

About the Survey The findings of the PROSALES Custom Home Builder Study are based on e-mail responses from 502 custom home building professionals who subscribe to BUILDER magazine and CUSTOM HOME magazine, sister publications of PROSALES. Questionnaires were e-mailed to subscribers in June 2005. The online survey was hosted by Specpan, an Indianapolis-based market research company owned by The Farnsworth Group. Specpan compiled the data, and analysts at The Farnsworth Group prepared a report on the survey results. (Note: Custom home builders interviewed for this story were not necessarily participants in the e-mail survey itself.)