When it comes to trim and siding, homeowners and production builders share a common desire: They want a material that’s durable and aesthetically pleasing and requires little maintenance. But when price enters the picture, the two groups split: Homeowners can accept higher prices for higher quality, while builders prefer to keep costs at a minimum.

This quality-versus-price tug-of-war is nothing new for the construction industry, but what is new is how emerging technologies can shift the balance one way or the other. With trim, the common trend from our Product Monitor last year was that PVC was gaining ground in a category still largely dominated by wood, as it provided the best durability and least maintenance, albeit with a higher price tag. Now, however, it looks as though PVC isn’t as hot as previously thought. “PVC is a high-end product, and builders want to maximize their bottom lines,” says Casey Olson, an industry analyst at Principia Consulting. “If durability and maintenance are comparable, builders, especially volume builders, will choose the cheaper product.”

Though PVC still wins outright on durability, especially in areas with moisture, Olson and others say warranties on treated wood are starting to become competitive. “Treated-wood products now offer an almost comparable warranty to PVC. And people like wood,” Olson says.

On the siding front, durability and cost are important, but aesthetics also play a major role. As a result, vinyl, the cheapest material and still very durable, appears to be losing market share.

“From our viewpoint, the vinyl siding market is relatively flat in terms of squares sold,” says Shawn Hardy, vice president and general manager at Alside. “Other cladding types have just grown faster.”

From an aesthetics standpoint, people are looking to integrate more than one material into the exterior of their home. “You don’t see homes clad in the same panel covering the entire exterior surface,” says Hardy. “At higher price points, other cladding materials are introduced … to add curb appeal.” According to the Census Bureau, vinyl siding was the most popular primary type of exterior wall material in homes built in 2017, with 27% market share. Fiber cement followed, at 20% share, while wood trailed at 5%.

Contrast that with five years earlier, when the Census Bureau said vinyl siding was on 32% of the homes built in 2012, while fiber cement’s share was just 16% (in 2005, it was 9%). Even in the Midwest and Northeast, where vinyl siding reigns supreme, market share has dropped five and four percentage points, respectively, in the past five years. “Vinyl had its heyday,” says Olson. “It’s vulnerable to share erosion.”

As different materials duke it out for supremacy in trim and siding, here’s what various makers say their products have going for them.

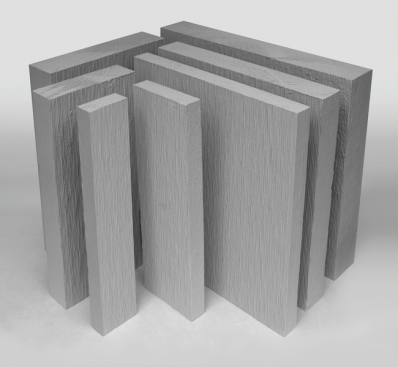

Trim

While some dislike its price tag, PVC is more versatile than ever. Darker, bolder colors are being introduced—something the material couldn’t manage a few years ago. Alside has released several colors, such as grays, blues, browns, greens, and reds. “Advancements over the last few years in polymeric technologies have helped pave the way for these dark colors,” says Alside’s Hardy.

These colored PVC trims are helping the material with ease of installation, as well. Speeding up install times is key in a tight labor market, and pre-colored trims go a long way on that front. Mark Lipsius, national sales and business development manager at Chelsea Building Products, adds that PVC is easy to cut and can be installed with a concealed fastener.

As Lipsius says, a primary characteristic people look for in trim is that it “looks like wood without the problems of wood.” However, engineered wood might just have gotten rid of those problems.

Baxter Reimer, market development manager at Belco Forest Products, thinks treated wood has room to grow. “As trim products go, treatments are still a relatively new advancement for most manufacturers.”

Wood also has an advantage when it comes to ease of installation, continues Reimer. “There’s no trim product easier to install than real wood. No special tools are required for cutting it … [and] it’s much lighter than most other, composite trims.”

Belco's ArmorCoat XT debuted in 2015, giving customers the desired wood aesthetic with enhanced durability.

Siding

It’s no secret that fiber cement has been growing steadily in the siding space. It’s aiming to take over vinyl’s spot at the top, in fact. The material is durable and requires little maintenance, but it also costs more than vinyl.

Sami Rahman, vice president of products and segments at James Hardie, says a demand for more “factory-prefinished products” is growing, and the firm is putting out a number of offerings to answer that call.

While prefabricated products help, the installation process could be holding fiber cement back. According to Principia Consulting’s Olson, “You can have 15% breakage on-site with fiber cement,” she says. “Contractors who use it, unless [they’re] super-specialized with Hardie, need a lot of tools and time.”

Lipsius and Olson also note that OSHA has issued rules limiting the release of silica dust at construction projects. Fiber cement contains silica; wood and vinyl don’t.

Engineered wood has also made strides in siding. In general, engineered wood is priced between vinyl and fiber cement. As the material’s durability improves, some manufacturers, including LP, are putting out new, 16-foot vertical siding lengths that “speed up install times and eliminate seams,” according to Angie Kieta, market development manager at LP.

Kieta also says builders “appreciate the fact that LP products come pre-primed and ready to paint.” Dealers such as US LBM have gone further by selling pre-painted engineered wood siding. That service is particularly appealing in the Upper Midwest, where some houses built late in the year go without an exterior coat of paint until spring arrives.

James Hardie’s Rahman, however, argues that wood-based technologies have pitfalls, saying wood products “don’t fare well against fire and pests and require greater long-term maintenance.”

Whichever siding and trim material a contractor chooses, it’s clear no one type bests the competition in every respect. From aesthetics to durability to price, the front-runners in the materials race each offer advantages worth evaluating.