DIY Distribution

Masse says Hammond Lumber uses specialty distributors for kitchen cabinets and other custom items. But for the most part, Hammond prefers to purchase through full-line wholesalers such as BlueLinx, Huttig, and Boise, as well as its buying group to support full-blown stocking programs in such categories as roofing (Hammond’s yards are carrying IKO, CertainTeed, and Owens Corning) and decking (where it stocks TimberTech, Trex, Dow, and a local line called CorrectDeck) that are essential to its ability to ship products when its customers need them.

“We’re in non-urban markets, and our delivery area is wide,” says Masse, whose company operates from eight branches in Maine.

Masse says that the trend at Hammond over the last 20 years has been to buy more products directly. (See “Direct Connect,” page 48.) “The suppliers have lowered their minimums, and they’ve become more efficient. Now you can buy just about anything, especially if you’ve kept up with your own warehousing and tracking” capabilities, he says.

Hammond occasionally will use its headquarters yard in Belgrade, Maine, as a satellite distribution center, where it will bring in products to redistribute to its other years. 84 Lumber does the same thing. Cicero notes that in the Baltimore area, where 84 has 11 yards, its store in Bel Air, Md., is the de facto decking specialist from which the other area yards can draw product. The dealer also has 11 engineered wood hubs around the country, as well as 22 door shops serving its 370 yards nationwide.

Cicero notes, however, that the expanse of some product categories, such as plumbing and electricals, has become so great in the past decade, “we could never carry everything that our customers need.” And the extent that 84 Lumber’s uses distributors in general often depends on the size of the market it is serving. In its Pittsburgh region, for instance, where the dealer has 86 stores in Ohio, West Virginia, and Pennsylvania, it can provide from its own inventory such products as framing, roofing, drywall, and interior trim because the largest builder in that market, Heartland Homes, only starts a few hundred homes a year. Compare that to the Washington, D.C., market, where 84’s biggest builder customer, Gemcraft, builds around 1,500 homes per year, and its second biggest, Richmond American, starts around 800.

“We’ll sell to their contractors, but we’ll use distributors to stock and ship” building materials to their jobsites, says Cicero.

–John Caulfield is a contributing editor to ProSales.

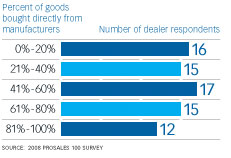

Direct Connect

For the first time in our annual ProSales 100 survey, we asked dealers to tell us what percentage of their goods they buy directly from manufacturers. Of the 75 companies that addressed the question, the results were almost equally distributed among five categories. Here are the responses.