North American precast concrete producers tell us they are buying more equipment, raising prices, and hiring more employees. Signs of better times are widespread: Puget Sound Precast is adding sales staff in Washington; Midwest Perma-Column is expanding product lines in Illinois; and in Pennsylvania, High Concrete is investing in new technology across its entire operation.

The National Precast Concrete Association (NPCA) confirms the trend. “According to our annual benchmarking survey, the precast concrete sector is experiencing its fourth straight year of solid growth,” says Ty E. Gable, NPCA president.

During the Great Recession, the association estimates U.S. sales of precast and prestressed concrete, and pipe contracted by about 40%. “The precast sector tends to lag about a year behind the rest of the construction industry, so we go into recession later and recover later,” Gable notes. But with strong performance in 2015, NPCA expects about half of those losses will have been recovered.

“The precast segment is very regional and some regions of the country have recovered better than others,” Gable says. “Because precast products are so diversified, the sales volume tends to go up and down with the local economy.”

According to TCP’s survey, public sector construction is strongest in the Northeast and Western states, commercial work leads in the Midwest, and Southern precasters report strong performance in commercial, residential, and infrastructure markets.

Most precast producers say infrastructure sales are strongest. Patrick Sibborn, who handles heavy civil sales for Oldcastle Precast in Atlanta, expects transportation budgets to have the biggest impact on business in the coming year. Precast accounts for 20% of Oldcastle’s Americas Products revenue.

Puget Sound Precast in Tacoma, Wash., is also counting on transportation funding to drive demand, says David Earl. The producer became state DOT-certified this summer.

Transportation bill

NPCA is advocating for passage of a long-term transportation bill and a permanent fix for the Highway Trust Fund. “There is sentiment in Congress for a long-term transportation bill, but no consensus on how to pay for it,” Gable says. “We are hopeful and working for a long-term bill, but it’s going to be difficult gathering momentum with all of the other issues Congress will be pressed to debate this fall.” (See “Public Spotlight.”)

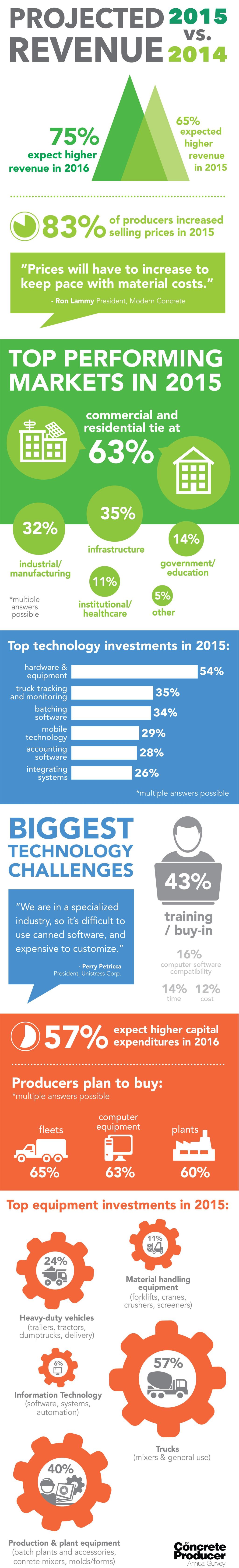

Overall, precasters expect revenue to improve this year, or match their 2014 results.

NPCA anticipates sales volumes could increase up to 10% in 2015, which would equate to about $19 billion for precasters. Earlier this year, Gable said he considered precast “well-positioned for the future,” citing the concrete industry’s growing emphasis on modularity, sustainable construction, and new technology.

Demand for precast will rise more than 6% annually through 2018, according to Precast Concrete Products, a study published this January by The Freedonia Group, an industry market research firm. As U.S. construction activity rebounds, the study says the benefits of precast concrete, such as reducing project time and expense and improving quality, will boost demand.

The report anticipates the highest demand over the next three years will be for structural building components, architectural building components, and transportation products.

For more, visit www.precast.org/blog and www.freedoniagroup.com. With concrete demand rebounding, producers reveal how they plan to keep up. Many turn to technology to gain advantage. The wood industry is aggressively working to gain market share over other building materials and influence building codes, especially in commercial mid-rise construction. Concrete producers are responding to customer demands by improving and expanding quality control services. 2015 TCP Survey results in one convenient location. Infrastructure sales lead to growth for the precast concrete industry. Top North American concrete producers remained unchanged in 2014. Here is how they ranked, based on revenue. Deals between private middle-market companies were structured to eliminate local competition. Larger, publicly traded companies continued to divest non-strategic operations to raise money for acquisitions.TCP Survey: Business Improving

TCP Survey: Wood Construction is a Threat

Realizing the Potential of Quality Control

The Concrete Producer 2015 Survey Infographic

TCP Survey: Precast and the Public Sector

TCP Survey: 2014 Top 10 Producers

2014 Top Mergers & Acquisitions for Concrete Producers