The Big Picture

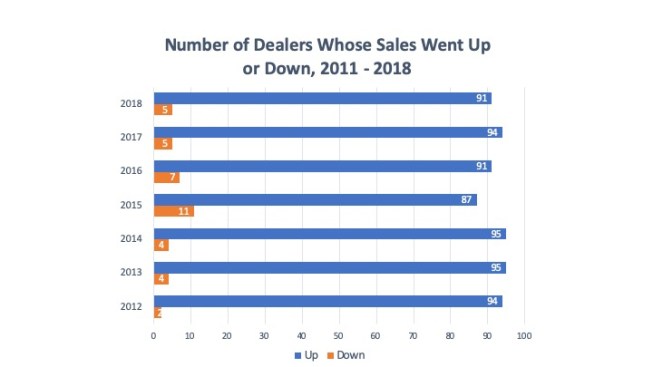

Aside from acquisitions, the only other way to grow an organization is organically, by increasing sales and trimming waste. And that’s what the ProSales 100 report focuses on. Collectively, the group did well, but there are some outliers. The lion’s share of companies, 91 dealers, increased their revenue year over year, while five saw a decline. Three were flat and one (ACS) couldn’t be factored, because it’s so new that it didn’t generate revenue in 2017.

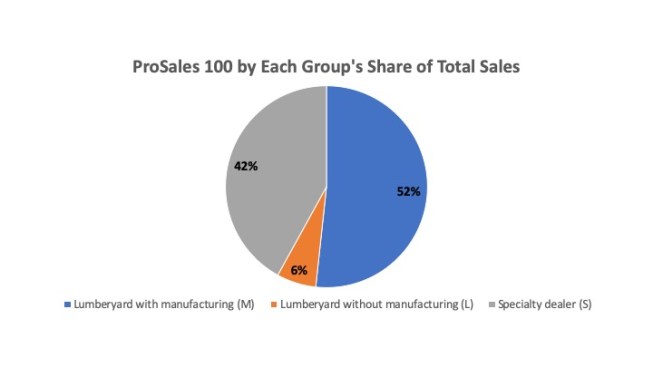

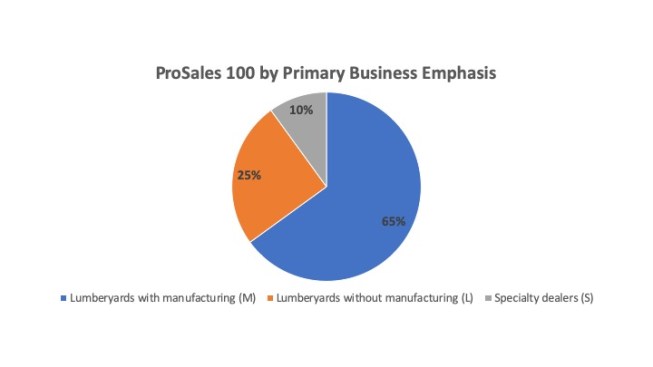

Taking a step back to gain a broad view of all 100 dealers on the list, it’s important to recognize the three types of companies that are represented: lumberyards with manufacturing capabilities, lumberyards without manufacturing capabilities, and specialty dealers.

The largest group on the list consists of 65 lumberyards with manufacturing capabilities. This group generated $31.7 billion (nearly 52%) of the group’s overall revenue. There are 25 lumberyards without manufacturing capabilities, which contributed only $3.9 billion (about 6%) to the group’s overall revenue. There aren’t many specialty dealers on the PS100 list—you’ll find only 10. However, this small group punches well above its weight, accounting for an impressive $25.8 billion (42%) of the PS100’s overall revenue.

Compared to last year’s list, the share of lumberyards without manufacturing dropped from 30% to 25% this year. On the contrary, yards with manufacturing edged up from 59% last year to 65% of the companies in this year’s group. Specialty dealers changed slightly from 11% of last year’s list to 10% of this year’s group. Considering the growth of the overall industry in recent years, the numbers suggest that if your company is only focusing on selling products and not providing additional services, business will only get tougher, especially during an economic downturn.

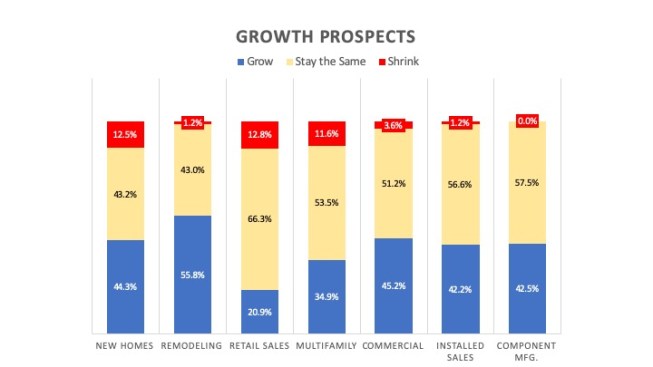

And that’s exactly what many pro dealers are expecting. The most ominous-looking chart of all in this report is the Growth Prospects chart. By itself, the chart (below) doesn’t look so bad. In fact, only modest declines are expected in the various categories measured in this chart. The largest declines as a percentage of overall revenue expected this year are in retail sales and new home sales, with 12.8% and 12.5% of dealers forecasting declines in these areas, respectively. But, when you compare this year’s numbers to last year’s, the chart looks noticeably bleaker.

For example, this year, 44.3% of dealers expect revenue from new home sales to grow as a percentage of their overall sales in 2019. This might sound good, but it’s a sharp decline from 82.1% last year. Additionally, last year, 64.6% of dealers expected remodeling sales to grow as a portion of their overall sales. However, this year, that number dropped to 55.8%.

While overall confidence in remodeling sales are down from last year, it’s the brightest spot on this year’s chart, which is consistent with what experts forecast. At the ProSales 100 conference, Mark Boud, chief economist at Metrostudy (owned by ProSales’ parent company, Hanley Wood), stated there are various factors preventing retiring baby boomers from selling their homes, such as the high cost to buy a new house and the reluctance to surrender low-interest mortgages on their existing homes. As a result, he stated, they are, instead, choosing to stay put and remodel their homes.