The logic of paying more up front, instead of taking a financial hit on the back end resulting from poor management, misorders, or shoddy work, applies to Outlaw’s management of her company’s trio of installed sales categories. In addition to herself, Outlaw has a full-time field rep who spends all day on jobsites verifying specifications, measuring rough openings, confirming door swings, and placing orders for installed products. “You need someone out there all the time,” says Outlaw, who splits her own time between a desk and her vehicle. “You can’t do this from an office, and the extra expense [for the field rep] is a cost-preventative measure.”

That’s a switch from early-adopting dealers who saw installed sales as a necessary evil instead of a profit center. Today, as more builders look for and rely on one-stop materials and labor shops to get their homes built, many dealers offering installed sales realize the value in paying attention to details, such as verifying specifications twice or more before sending the installer out on a job. “If you don’t, more than likely your program won’t be profitable,” says Outlaw, much less trusted by the market.

Labor Ready? The people question also extends to the age-old dilemma of whether to hire subcontractors or in-house crews to handle the labor of an IS program. Historically, dealers chose one or the other and weathered whatever storms that decision wrought.

Now, prevailing wisdom promotes a hybrid approach and category-specific decisions. “If you can train someone easily and within a few days, hire in-house,” Burleson says, pointing to new-construction windows as an example of a product that is relatively easy for an installer to learn. “If the product requires a skilled craftsman to install, such as siding, roofing, or replacement windows, use subs in the beginning.”

Starting with subs and eventually hiring in-house is an increasingly popular option among successful IS programs, though dealers are willing to make adjustments to suit the circumstances. “When we could use in-house labor, we did,” says Harley Yoder, general manager of Yoder’s Building Supply, a single-location dealer in Fair Play, S.C., that earns 22 percent of its $35 million in total annual revenue from seven installed sales categories (15 percent alone from cabinets). “But we started very small and grew with subs,” he says, before hiring full-time, in-house crews. Yoder’s IS division, which splits the products offered into three divisions (each with a manager) has grown from one person managing garage door installs to a payroll of 60 staffers.

Roper Bros. Lumber Co., an $88 million, five-location dealer that currently offers installed cabinets, vinyl siding, insulation, and “post-paint” products out of its Petersburg, Va., flagship location, is following a similar tactic. “Most of our installs are subbed out now, but I can see us moving more toward in-house crews as the business grows,” says branch manager Al Showerman. “Once we have enough business to support someone on the payroll full-time, we’ll do it,” adding that he’ll also gain a higher level of scheduling and quality control in the process.

Unfortunately, there is no magic number for that decision, though Butts suggests that if there’s enough work to keep a subcontracted installer busy 40 hours a week for 50 weeks a year, the time is right to bring the crew into the corporate fold—a decision, he says, that is ultimately more cost effective and profitable than subcontracted labor because it allows the dealer to better control costs and manage risk.

He adds that subs today are also more willing than in the past to go on the payroll—primarily for employment benefits including health insurance and vacation time, as well as for relief from rising liability insurance rates, complex accounting and bill collecting, and scouting for future work. “They’re tired of managing their own time and jobs,” adds Butts, who also suggests spreading the work among a few subs as an IS program gets up and running to gauge their skills and attitude before selecting one to come in-house.

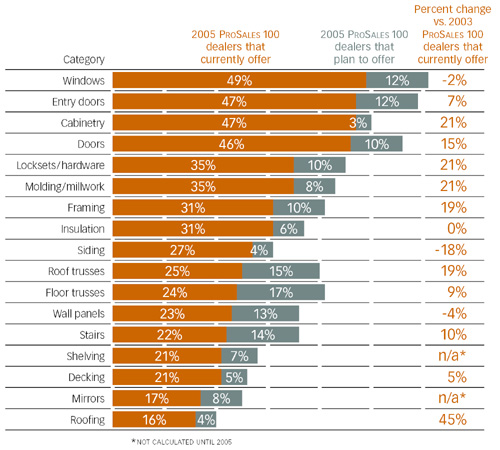

Growth Opportunities The 73 dealers, distributors, and wholesalers in the 2005 PROSALES 100 that report offering installed sales operate their programs in at least one of 17 product categories, ranging from windows and entry doors to decking, roofing, framing, and cabinets. No one category has more than 50 percent participation among the top 100 dealers; the highest is 49 percent (windows) and the average is 30 percent, both almost unchanged in three years.

What’s more telling are the changes among the categories. Between the 2003 and 2005 PROSALES 100 surveys, only four of the 17 categories were flat or had lower participation among dealers (led by an 18 percent slide in those offering installed siding), while eight categories showed double-digit growth since then (see “Growth Mode,” above). In addition, nine of those 17 product categories are reportedly on the horizons of at least 10 percent of the top-ranking dealers. “Dealers are both reacting to demand [from pros] and actively conducting market research and finding niches of new products to install,” says Butts.