That’s another key to success, he says, and a sea change from the past: dealers relying on the market to dictate growth in installed sales rather than trying to direct the market or respond to competitors’ efforts. “We have to be careful that whatever we do is a real need [for our customers],” says Yoder. “There have been times when it’s not the right time [to offer a product installed], even if we could do it. When enough builders ask us, we’ll do it.”

In Outlaw’s market, she sees the installed sales landscape saturated; what Builders Supply doesn’t offer installed, specialty dealers and subs already do. “Everyone’s got a niche, so there’s no untapped avenue to broaden into,” she says. Instead, Outlaw will focus on growing market share in her existing IS categories, initially among production builders and then as smaller builders learn more about the value of installed products.

Other dealers have taken to packaging installed sales categories (such as the “after-paint” niche, a high-margin category that can add up to $3,000 per house) and/or ventured onto less-beaten product paths, such as stonework, fireplaces, garage doors, and tubular skylights, to gain more of the takeoff and embed builder loyalty. “Once you have five or so products on a jobsite, it’s hard for the builder to replace you [as a supplier],” says Butts. “If you install them, that effectively doubles the number of products you provide.”

Gaining Support Burleson looks at installed sales as a three-legged stool, with the dealer, the right manager, and the upstream supplier (the distributor and/or the manufacturer) as equally necessary components. “If one of the legs is weak, the program will have issues.”

While dealers seem to be getting on board with the proper corporate support and managerial hiring practices for their IS ventures, most suppliers lag behind. “They have their channels defined, and supporting installed sales is a cost they either have to absorb or add to their pricing,” says Burleson, thus curtailing their motivation to provide handling and installation training, tools, sales education, and even a reliable supply of product to support the effort.

Butts goes further, contending that some manufacturers—specifically window makers—are concerned about their liability if they get too involved or even write more specific installation specs to support a dealer’s installed sales program for their products.

That said, he and others do see some movement among manufacturers to wake up to their role in a dealer’s IS success. In addition to reaping a portion of impressive sales revenues and enjoying steady orders, a few vendors also are gaining the proper vision. “The future is installed sales,” says Butts, “not just products.” —Rich Binsacca is a contributing editor for PROSALES.

Tips for Installed Sales Success

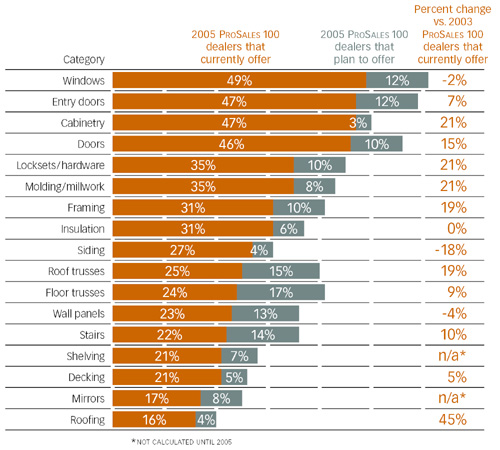

Growth Mode Overall, PROSALES 100 dealer participation in at least one installed sales category grew 9 percent between the 2003 and 2005 PROSALES 100 listings, with extensive growth in some categories on the near horizon.

SOURCE: PROSALES 100, 2003–2005