A decline in American dynamism is a thing.

Just how much that phenomenon impacts new residential construction trends and the livelihoods of thousands of firms that draw sustenance from building new homes when and where they’re needed will play a big role in land buys, community planning, and home product design, not to mention leveraging data to match people to homes.

We’ve looked at American mobility trends that show a long-tail downward trajectory in the rates people move–and explored some of the implications of that sweeping macro population pattern–in three articles over the past several months, here, here, and here.

Will new tax laws–which put disproportionate burden on people who own or are paying off homes in expensive states where they’re also paying high property taxes and high local taxes–work as a new catalyst to mobility trends? That remains to be seen.

What’s clear is that a key ingredient of what causes people to want to move has lost momentum, and continues to lose traction, nationally, and, with the exception of a few industry sectors and a relatively few geographical markets, locally.

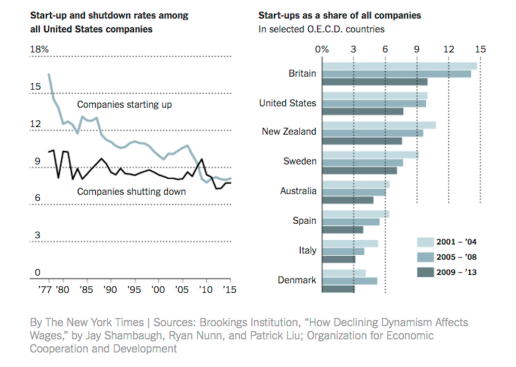

This ingredient–a measure of America’s capacity to generate growing prosperity–is that breeder-reactor of American economic power: fast-growing business start-ups. New York Times economics correspondent Eduardo Porter wrote recently of the fall-off in business formation trends and the collateral effects–flatline wages and lower standards of living–of the trend here. Porter notes:

The evidence paints a distinct picture of decline: Fewer start-ups mean fewer new ideas and fewer young, productive businesses to replace older, less productive ones. Researchers have found that the decline in companies entering the market since 1980 has trimmed productivity growth by about 3.1 percent.

The dearth of new businesses is also cutting off one of the main paths to workers’ advancement: the outside job offer. Changing jobs allows workers to shift to positions in which they are more productive, and better paid. But labor market fluidity — job switching, creation and destruction — has been declining since the 1980s.

Of course, what’s telling if you’re in the business of divining where opportunity and growth in dynamic entrepreneurial ventures are the exception to the rule of decline, is that high-growth companies cluster and concentrate rather than to disperse evenly across the nation’s small, medium-sized, and big market areas. Ian Hathaway, Brookings Institution senior fellow in the Metropolitan Policy Program, stepped back and took a look at Inc. 5000 data for the years 2011 to 2017, and explored and filtered them by geography, industry sector, and business performance metrics. Here’s the way Hathaway describes the lot of what he calls HGCs:

- They achieve high rates of growth in revenue or employment or both;

- They make substantial contributions to aggregate productivity growth;

- They tend to be small;

- They tend to be young;

- They tend to be concentrated in knowledge-intensive industries.

Now, since it’s Valentine’s Day and we hope you’ll be ours, we’ll give you constructive ideas about what all this means, and what it could mean to your ability to make a healthy go of life as a new home builder in an American landscape where fewer people move because there’s more reasons to stay put and less reasons to expend the time, effort, discomfort, and money to up and move to some place new.

First, though, it’s relevant for us to check out one other piece of data related to all of this, and it comes from the latest set of analyses put out by Zelman & Associates in The Z Report (which you can access on a free-trial basis by clicking here).

The gist of one of the eight in-depth analytical essays in The Z Report ties directly to this side effect of the decline of dynamism and its effect on Americans’ likelihood of moving from a home they buy.

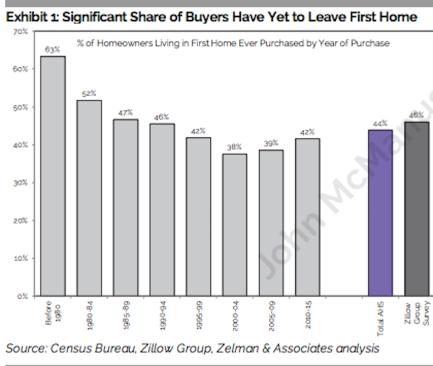

The contrarian view here–especially as we consider young adult millennial home buyers–is that a first-time purchase of what we call an “entry-level” home is more than that. In fact, in a significant number of cases–perhaps more than two out of five–a first-time buyer’s entry-level home is also a first-time move-up, second-time move-up, and a 55+ home, all in one fell swoop. Zelman analysts note:

We utilize data from the Census Bureau’s American Housing Survey, which dives deeply into housing-related metrics every other year. The latest survey was conducted in 2015 and released last year. According to the survey, 44% of homeowners still live in the first home they purchased. We believe this figure is far higher than what a sample of housing professional estimates would produce.

Now, let’s cut to the chase on some implications.

Trust the data, not your gut.

- If more than two out of five home buyers of first-time entry-level homes through the years are still in them, then we need to clear up the misconception of what a first-time entry-level home is. In fact, 44% of the homes you’re selling to Millennials may be the home they retire in and spend 55+ years in. So, land position, design, flexibility, and durability re-map themselves as priorities, values, and non-negotiables.

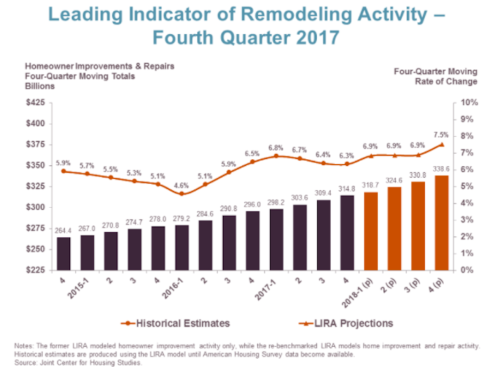

- Secondly, we know remodeling is fast becoming the “new-home” option for many. Here, from the latest Leading Indicator of Remodeling Activity release by the Joint Center for Housing Studies at Harvard.

- Homeowner expenditures on improvements and repairs will rise 7.5% in 2018 from last year to approach $340 billion, according to the Leading Indicator of Remodeling Activity (LIRA) released today by the Joint Center for Housing Studies of Harvard University.

- The real Valentine take-away, however, is probably the one that will cause a reflexive dissmissal. It’s this: If you look at a first-purchase new home on a piece of property as an opportunity to have a lasting, highly-profitable relationship, not only with the buyer, but with the resident who’ll need services, upgrades, additions, replacements, remodels, etc. on that home, perhaps through an entire adult life, you’re in a different, more resilient business. You’ve got all the data on people making the biggest financial decision of their lives. Why not continue to leverage it into helping them make their lives what they want in the home they love?

Car companies still sell cars, but they make a lot of money servicing them.

With the changes in componentization, firm-ware, factory assembly, nimble floorplans, and the strength and durability of structural parts of an enclosure, the business of being new home builders could be verging on a business of being profitable in a homes- and communities-as a service model.

Happy Valentines Day!