The key word here seems to be balance. Whether a remodeler weighs price or a particular service more heavily, it’s often the balance between the two that’s most important.

Stover touches on an important point because remodelers tend to gravitate toward those suppliers that will go beyond the call of duty. “I don’t jump around just to get a [lower] price,” says Tim Shigley, president of Shigley Construction in Wichita, Kan. “The baseline for me is the relationship you build with a supplier, in which we put a tremendous amount of trust.” David Crane, who owns Crane Builders, a $3 million remodeler based in Nashville, Tenn., states that one local yard, Robert Walker Lumber, gets a good chunk of his company’s building materials purchases because of its “willingness to deliver on short notice.”

More than three-quarters of the survey’s respondents graded “loyalty/past relationships” an 8 or better as a criterion for selecting a supplier, about the same percentage that said they’d favor a supplier with higher-than-average prices that also delivers higher-than-average service. What constitutes “service,” though, varies by remodeler, and some have pretty basic requirements: They simply want orders filled accurately and on time. “We’ve been favoring a local yard called Prestige Lumber because they know they are supposed to send us their best [materials],” says Marion McGrath, co-owner of Orlando, Fla.–based Jonathan McGrath Construction, whose cost of goods is about 25 percent of its $1.8 million in annual sales. “They want our business and will do what it takes to keep it.”

Others remodelers stick with suppliers and distributors that are long-standing partners. Murphy Bros. buys “the bulk” of its lumber from a local yard, Interstate Lumber, “which we’ve been doing business with since we were a $500,000 company,” Anechiarico says. As a result, “we’ve gotten access to Interstate’s online accounting, and much better in-field service. They’ll jump on one of our orders, where someone we don’t use as frequently might not be as quick.”

Additionally, Rainbow Construction, a general contractor and builder in Cape Elizabeth, Maine, purchases 70 to 80 percent of its commodities from Hancock Lumber’s yard in Yarmouth, Maine, which had been Rainbow’s primary supplier when Hancock bought it several years ago. Craig Cooper, Rainbow’s owner, went to high school and college with Hancock’s outside salesman, Alan Carr. “I will buy wherever he works, and Alan got me to go over to Hancock in the first place,” he recalls.

Rainbow has purchasing relationships “all over the place” with dealers and suppliers: a Kohler distributor, a drywall specialist “who also does the taping,” and so forth. But the dealer keeps returning to Hancock Lumber for most commodities because, Cooper explains, he has a direct line to people he knows, and Hancock provides engineering assistance on the jobsite. This relationship has been “a good mix,” adds Cooper, because “I was growing and they were growing.”

Loyal Customers While he draws upon several supply options, Cooper definitely is not a fan of the big boxes. “They are really just big hardware stores,” he says. The survey’s respondents echoed Cooper’s sentiments, not giving big boxes very high ratings on overall service, with 69 percent and 61 percent of the respondents ranking both The Home Depot and Lowe’s, respectively, a 5 or less on a 1-to-10 scale, with 1 being extremely poor and 10 being extremely good. In contrast,69 percent of the respondents ranked their local building materials dealer as an 8 or greater on the service scale. Even more revealing is the finding that remodelers don’t think warehouse pricing is much more competitive, either.

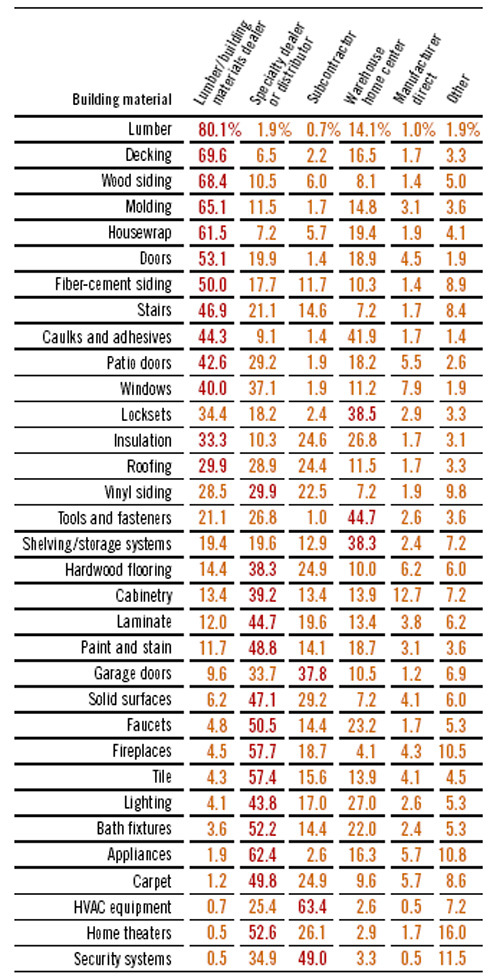

However, while many pro dealers scoff at The Home Depot’s claim that 30 percent of its stores’ sales come from pros, big box penetration with remodelers—especially in certain product categories—cannot be so easily dismissed. Between one-quarter and one-half of the remodelers polled in this survey said they prefer big boxes to other venues for tools and fasteners, locksets, caulks and adhesives, lighting, insulation, and shelving and storage (see Figure 1).

And in metro markets where big boxes are now pervasive, remodeler acceptance of these stores as primary suppliers is more common. “Home Depot is my second home,” Ralph Freeman of Atlanta-based J&J Contracting told Cox News Service in June while shopping at The Home Depot’s store in Morrow, Ga. “If I’m at a dead-end in a job, I’ll ask one of the guys here and they steer me in the right direction. On a scale of 1 to 10, I give them an 11.”

While Freeman may be gung-ho on all aspects of purchasing from warehouse home centers, a more typical remodeler’s buying pattern tends to show a diversity of sources, as seen at Arthur Bradley Design/Build, whose cost of materials consumes about one-third of its $7 million annual revenue. In addition to employees’ quick product pickups at the Home Depot next door, the company purchases lumber from two local pro dealers, Dixieline Lumber and Ransom Bros. Lumber & Supply, mostly because their yards are close to its headquarters. Its roofing wholesaler buys the products it installs. The remodeler sends drywall subs to The Home Depot or Dixieline for Sheetrock. In addition, “We like to be near a supplier with a showroom that we can send our clients to,” says Schuber, a preference that gives The Home Depot and Dixieline (which has two millwork showrooms in town) a leg up, as well as plumbing distributor Ferguson Enterprises, whose local warehouse displays bath fixtures in “booths” and “suites,” says Schuber.